BANK NOTE:

A banknote (often known as a bill, paper money, or simply a note) is a type of negotiable instrument known as a promissory note, made by a bank, payable to the bearer on demand. When banknotes were first introduced, they were, in effect, a promise to pay the bearer in coins, but gradually became a substitute for the coins and a form of money in their own right. Banknotes were originally issued by commercial banks, but since their general acceptance as a form of money, most countries have assigned the responsibility for issuing national banknotes to a central bank. National banknotes are legal tender, meaning that medium of payment is allowed by law or recognized by a legal system to be valid for meeting a financial obligation. Historically, banks sought to ensure that they could always pay customers in coins

when they presented banknotes for payment. This practice of "backing"

notes with something of substance is the basis for the history of central banks

backing their currencies in gold or silver. Today, most national

currencies have no backing in precious metals or commodities and have

value only by fiat. With the exception of non-circulating high-value or precious metal issues, coins are used for lower valued monetary units, while banknotes are used for higher values.

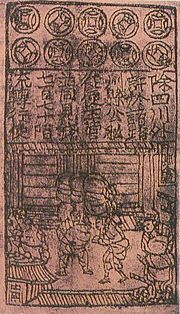

The idea of a using durable light-weight substance as evidence of a

promise to pay a bearer on demand originated in China during the Han Dynasty in 118 BC, and was made of leather.[3] The first known banknote was first developed in China during the Tang and Song dynasties, starting in the 7th century. Its roots were in merchant receipts of deposit during the Tang Dynasty (618–907), as merchants and wholesalers desired to avoid the heavy bulk of copper coinage in large commercial transactions.[4][5][6] During the Yuan Dynasty, banknotes were adopted by the Mongol Empire. In Europe, the concept of banknotes was first introduced during the 13th century by travelers such as Marco Polo,[7][8] with proper banknotes appearing in 1661 in Sweden.

|

| The world's earliest paper money |

| |

| A Yuan dynasty printing plate and banknote |

|

| The first paper money in Europe, issued by the Stockholms Banco in 1666. |

|

| Fifty-five dollar bill in Continental currency; leaf design by Benjamin Franklin, 1779 |

CURRENCY:

A currency (from Middle English: curraunt, "in circulation", from Latin: currens, -entis) in the most specific use of the word refers to money in any form when in actual use or circulation, as a medium of exchange, especially circulating paper money. This use is synonymous with banknotes, or (sometimes) with banknotes plus coins, meaning the physical tokens used for money by a government.

A much more general use of the word currency is anything that

is used in any circumstances, as a medium of exchange. In this use,

"currency" is a synonym for the concept of money.

A definition of intermediate generality is that a currency is a system of money (monetary units) in common use, especially in a nation. Under this definition, British pounds, U.S. dollars, and European euros

are different types of currency, or currencies. Currencies in this

definition need not be physical objects, but as stores of value are

subject to trading between nations in foreign exchange markets, which determine the relative values of the different currencies.

Currencies in the sense used by foreign exchange markets, are defined

by governments, and each type has limited boundaries of acceptance.

The former definitions of the term "currency" are discussed in their respective synonymous articles banknote, coin, and money.

The latter definition, pertaining to the currency systems of nations,

is the topic of this article. Currencies can be classified into two monetary systems: fiat money and commodity money,

depending on what guarantees the value (the economy at large vs. the

government's physical metal reserves). Some currencies are legal tender

in certain jurisdictions, which means they cannot be refused as payment

for debt. Others are simply traded for their economic value. Digital currency arose with the popularity of computers and the Internet.

COINAGE:

These factors led to the metal itself being the store of value: first

silver, then both silver and gold, and at one point also bronze. Now we

have copper coins and other non-precious metals as coins. Metals were

mined, weighed, and stamped into coins. This was to assure the

individual taking the coin that he was getting a certain known weight of

precious metal. Coins could be counterfeited, but they also created a

new unit of account, which helped lead to banking. Archimedes' principle provided the next link: coins could now be easily tested for their fine

weight of metal, and thus the value of a coin could be determined, even

if it had been shaved, debased or otherwise tampered with (see Numismatics).

Most major economies using coinage had three tiers of coins: copper,

silver and gold. Gold coins were used for large purchases, payment of

the military and backing of state activities. Silver coins were used for

midsized transactions, and as a unit of account for taxes, dues,

contracts and fealty, while copper coins were used for everyday

transactions. This system had been used in ancient India since the time of the Mahajanapadas. In Europe, this system worked through the medieval period because there was virtually no new gold, silver or copper introduced through mining or conquest. Thus the overall ratios of the three coinages remained roughly equivalent.

PAPER MONEY:

In premodern China, the need for credit and for a medium of exchange that was less physically cumbersome than large numbers of copper coins led to the introduction of paper money, i.e. banknotes. Their introduction was a gradual process which lasted from the late Tang Dynasty (618–907) into the Song Dynasty (960–1279). It began as a means for merchants to exchange heavy coinage for receipts of deposit issued as promissory notes by wholesalers' shops. These notes that were valid for temporary use in a small regional territory. In the 10th century, the Song Dynasty government began to circulate these notes amongst the traders in its monopolized

salt industry. The Song government granted several shops the right to

issue banknotes, and in the early 12th century the government finally

took over these shops to produce state-issued currency. Yet the

banknotes issued were still only locally and temporarily valid: it was

not until the mid 13th century that a standard and uniform government

issue of paper money became an acceptable nationwide currency. The

already widespread methods of woodblock printing and then Pi Sheng's movable type printing by the 11th century were the impetus for the mass production of paper money in premodern China.

In Europe, paper money was first introduced on a regular basis in Sweden in 1661 (although Washington Irving records an earlier emergency use of it, by the Spanish in a siege during the Conquest of Granada).

Sweden was rich in copper, thus, because of copper's low value,

extraordinarily big coins (often weighing several kilograms) had to be

made.

The advantages of paper currency were numerous: it reduced the need

to transport gold and silver, which was risky; it facilitated loans of

gold or silver at interest, since the underlying specie

(gold or silver) never left the possession of the lender until someone

else redeemed the note; and it allowed a division of currency into

credit and specie backed forms. It enabled the sale of stock in joint stock companies, and the redemption of those shares in paper.

But there were also disadvantages. First, since a note has no

intrinsic value, there was nothing to stop issuing authorities printing

more notes than they had specie to back them with. Second, because it

increased the money supply, it increased inflationary pressures, a fact

observed by David Hume

in the 18th century. Thus paper money would often lead to an

inflationary bubble, which could collapse if people began demanding hard

money, causing the demand for paper notes to fall to zero. The printing

of paper money was also associated with wars, and financing of wars,

and therefore regarded as part of maintaining a standing army.

For these reasons, paper currency was held in suspicion and hostility

in Europe and America. It was also addictive, since the speculative

profits of trade and capital creation were quite large. Major nations

established mints to print money and mint coins, and branches of their treasury to collect taxes and hold gold and silver stock.

At that time, both silver and gold were considered legal tender, and accepted by governments for taxes. However, the instability in the ratio

between the two grew over the course of the 19th century, with the

increases both in supply of these metals, particularly silver, and in

trade. The parallel use of both metals is called bimetallism, and the attempt to create a bimetallic standard where both gold and silver backed currency remained in circulation occupied the efforts of inflationists. Governments at this point could use currency as an instrument of policy, printing paper currency such as the United States Greenback,

to pay for military expenditures. They could also set the terms at

which they would redeem notes for specie, by limiting the amount of

purchase, or the minimum amount that could be redeemed.

By 1900, most of the industrializing nations were on some form of gold standard, with paper notes and silver coins constituting the circulating medium. Private banks and governments across the world followed Gresham's Law:

keeping the gold and silver they received, but paying out in notes.

This did not happen all around the world at the same time, but occurred

sporadically, generally in times of war or financial crisis, beginning

in the early part of the 20th century and continuing across the world

until the late 20th century, when the regime of floating fiat currencies

came into force. One of the last countries to break away from the gold

standard was the United States in 1971.

No country anywhere in the world today has an enforceable gold standard or silver standard currency system.